Running a business can be hard. People underestimate just how much time, knowledge, and passion goes into creating a brand and generating revenue. There is so much competition these days that it is almost impossible to create a successful new business unless you really give it your all and use every single advantage at your disposal. One of the advantages that many people tend to overlook, however, is the credit card swiper! When it comes to merchant processing, few things are as useful as a credit card swiper. Keep reading for tips about how to find the best one for your business!

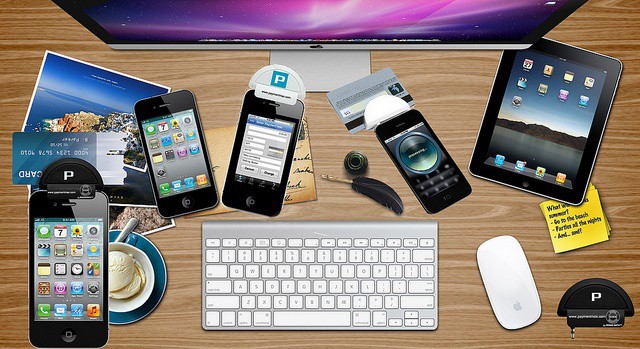

Wireless credit card reader

One of the first things to consider when determining whether you should invest in a credit card swiper for your merchant processing needs is its convenience and usability for your business. A wireless credit card reader, for example, can be an incredibly useful tool to help make business transactions easier and quicker, for both the customer and the merchant. If you are interested in making it easier for clients to complete transactions with your business, then you might want to consider investing in a credit card swiper.

Lowest credit card processing fees

Something else to keep in mind when considering a credit card swiper is how much money you can expect to lose via processing fees. You want to carefully weigh your options and select a service provider willing to give you the lowest credit card processing fees possible in order to minimize the amount of money taken from your transactions.

Are you looking for help selecting a credit card swiper? Merchant Account Solutions can help! Take a look at their services and contact them today.